Peak oil, what will it mean to our daily lives? In 20 years? 30 years? 100 years? Peak natural gas, something not as widely talked about as peak oil, what is it and how it will affect us? How will currencies be affected(after all this is a currency blog), will currency even survive the crash?

Let me start by laying down the basics. Peak oil is the point in time when the maximum rate of global petroleum extraction is reached, says wikipedia(Wikipedia article on Peak oil). In other words we've extracted so much oil from the earth that we're at the point where our daily output can't go any higher and can only go down.

The image is simple but a picture is worth 1000 words right? This is a graph of our oil production capacity over time, we're at the peak now, and maybe past the peak already.

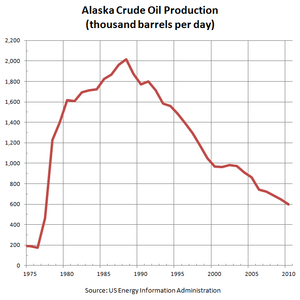

How can we tell we're at the peak? Well that's the tough part, no one can say it's the peak for sure, we're talking world wide peak. The US peaked sometime in the 80s, as illustrated by this chart.

Source Wikipedia |

There is data on world wide production of oil here. To summarize that table, since the 1960 yearly oil production has increased steadily, all the way until 2005, when it hit 73.72 million barrels per day, since 2005 it has fluctuated but has remained around the same level, roughly 73 million per day on average. Perhaps this could be explained with reaching our current production limit with the technology we have, and soon we will invent new ways of extracting oil and will start pumping oil at higher levels. But this time it looks different, The U.S. peaked long ago, even with new technology the US is in decline. And on a global lever we've stayed at this production level for the longest time in history, for 6 years now since 2004. That's telling us that it's getting difficult to increase our daily output, in other words we're at the peak.

So what happens when our oil production curve flattens or starts declining. In the next paragraph I look at GDP growth and its correlation to oil production growth.

So what happens when our oil production curve flattens or starts declining. In the next paragraph I look at GDP growth and its correlation to oil production growth.

The following chart shows world GDP growth over the last 40 years

As we can see GDP growth has had a lot of ups and down, I will try to see if there are any correlations with oil production. The following chart shows oil production growth.

Chart created using data from above mentioned oil production values |

Those 2 charts are very similar, quite amazing, we now see a pattern here. But did the GDP growth slowdown cause us to extract less oil, or was it that oil extraction growth guided GDP growth? I think it's oil, and here's why.

Let's focus on the the extremes of the charts, in the 70s, and then in the 80s we had big dips in both charts. The 1973 oil crisis is what's responsible for the first dip, and again in 1979 the 1979 energy crisis.

1973, The 1973 oil crisis started in October 1973, when the members of Organization of Arab Petroleum Exporting Countries or the OAPEC (consisting of the Arab members of OPEC, plus Egypt, Syria and Tunisia) proclaimed an oil embargo "in response to the U.S. decision to re-supply the Israeli military" during the Yom Kippur war; it lasted until March 1974(source wikipedia - http://en.wikipedia.org/wiki/1973_oil_crisis)

1980, following the Iraqi invasion of Iran, oil production in Iran nearly stopped, and Iraq's oil production was severely cut as well. After 1980, oil prices began a six-year decline that culminated with a 46 percent price drop in 1986. This was due to reduced demand and over-production, which caused OPEC to lose its unity. Oil exporters such as Mexico, Nigeria, and Venezuela expanded production. Ending of price controls allowed the US and Europe to get more oil from Prudhoe Bay and the North Sea(source wikipedia - http://en.wikipedia.org/wiki/1979_energy_crisis)

Graph of oil prices from 1861–2007, showing a sharp increase in 1973, and again during the 1979( |

Both of these events show that due to oil production decrease, world GDP growth slowed, and in some countries it was negative, USA, UK, Canada(however Canada was not as hurt since it is a big oil prodcuer, and in 1970s it actually benefited from the crisis and had positive GDP growth)

Whatever the reason for oil production growth decline, be it war or embargoes, it's obvious that it reflects world GDP negatively.

Back to peak oil. What will happen when production starts declining? Oil prices will go up, there might be oil shortages even, possible wars over oil. All of this is negative for any economy in the world and even more detrimental to societies in North America. Why North America? North america is pretty unique in the way people live, we go to work 50 miles away, we shop 10 miles away, we go to the movies 15 miles away, etc. We're very spread out, everyone owns a car, a family lives in a 2 story house. Elsewhere in the world this way of life is impossible for many reasons but I'm not going to go into details.

Roads need to be maintained, houses are built all the time, all of this is fueled with oil, and a lot of it!

When oil prices start going higher, we won't be able to afford our cars anymore, but this won't be temporary price increase in oil, it will mean increasing prices until we figure out another way to live. Maybe we will have electric cars by then that will save us...wrong, we need electricity for those, and electricity in North America is largely produced using natural gas. Some people are big believers in solar/wind energy. But those sectors are too small and aren't growing as fast as we'd like them to.

Oil is not the only fossil fuel that can peak, same goes for natural gas. Natural gas is not so widely talked about, because we don't use it explicitly, but it is fueling our backbone - electricity.

Let's look at natural gas reserves and consumption.

Natural Gas consumption in USA, source |

So to summarize the charts, we have 6.254 trillion cubic feet of natural gas in the world, and only in the US consumption is 22.7 million per year. I was able to find a number for world consumption here, in cubic meters. By adding it all up and converting to cubic feet, we get 72.186 billion cubic feet per year of worldwide consumption.

How long will it take us to use up all this natural gas? 86.64 years. I didn't account for increase in consumption*

Read more about world resources and consumption here.

All this paints a pretty bleak picture for the world that we live in, especially north america. We're living a life that can't be sustained. Experts say that all alternative energy sources, wind, solar, thermal etc. can't replace the natural gas and the oil that we're used to. It seems though that we have plenty of time, most of us will be gone by the time we really run out of gas, but within our lifetime we'll probably see shortages and how that will affect our society remains to be seen.

I'd like to mention France here. France produces it's electricity mainly using nuclear power, this is great for their economy as they're less dependent on oil and this economy can quickly switch to electric vehicles in the case of oil shortages. Even more beneficial for France is their small size compared to US and Canada. There aren't as many roads to maintain and people live closer to each other.

On to currency the currency implications of peak oil. First of all oil will get expensive, how much, well it's hard to say, supply and demand will play a big part, at some price point no one will want to buy anymore oil. Imagine 1L of gas costing $50, while your salary is $50,000 per year, so to fill up your tank it will cost around $3000 this adds up to a lot more than 50,000 a year. So basic economics says that it will be economically unfeasible for you to drive your car to work. As this causes many people to ditch their cars the price would probably fall but the damage will be done. Food prices will get uncontrollably high because the trucks that deliver food are fueled by diesel. Who will be hit first is hard to say, but for sure car makers will take a big hit, layoff hundreds of thousands of workers, everything is in one way or another connected to oil so there will be job cuts in every possible sector. But these job cuts will be huge, unemployment will be well over 20% perhaps over 50%. In this scenario It's hard to say what will happen with currencies but gold for sure will be desired by everyone. Currency is just paper but gold is a precious metal with limited supply in the world.

Unless the global economy can adjust to a world without oil societies will have to shrink and become dependent only on each-other. We'll actually have to start planting our own food, install a solar panel, trade goods with our neighbors, become less wasteful, and change our values. The world is living an unsustainable way of life that will come to an end. How will the new world look remains to be seen.

No comments:

Post a Comment